37+ are mortgage interest tax deductible

13 1987 your mortgage interest is fully tax deductible without limits. Web Your mortgage interest is tax-deductible if you use your property to generate rental income.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Get Help Calculating Tax Deductible Income.

. Web If you took out your mortgage on or before Oct. Come tax time you would use the rental income and expenses. For tax year 2020 the top tax rate remains 37 for individual.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. But for loans taken out from. Web Mortgage interest.

The good news if you have a bigger mortgage is. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Web March 5 2022 246 PM. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Your financial situation is unique and the products and services we review may not be.

Homeowners who bought houses before. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Ad Ask a Tax Expert About Tax Deductible Limits.

You still have to report this interest to the IRS. Connect Online Anytime for Instant Info. For tax years before 2018 the interest paid on up to 1 million of acquisition.

You probably know by now that mortgage interest is tax Do you have a mortgage. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web Includes mortgage interest deductions closing cost deductions insurance deductions and more.

MIDs value to taxpayers depends on their marginal. Web Information provided on Forbes Advisor is for educational purposes only. Web The IRS places several limits on the amount of interest that you can deduct each year.

Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. Are you a Financial Advis. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Ask a CPA Online Any Question via Chat. Homeowners who are married but filing. Are you a Financial Advisor.

Web Do you have a mortgage. Web of all tax returns but they accounted for 59 of tax returns with itemized deductions Internal Revenue Service 2022. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Tax-deductible interest is interest you have paid on a loan that you can then subtract from your taxable income. Compare More Than Just Rates. Also if your mortgage balance is.

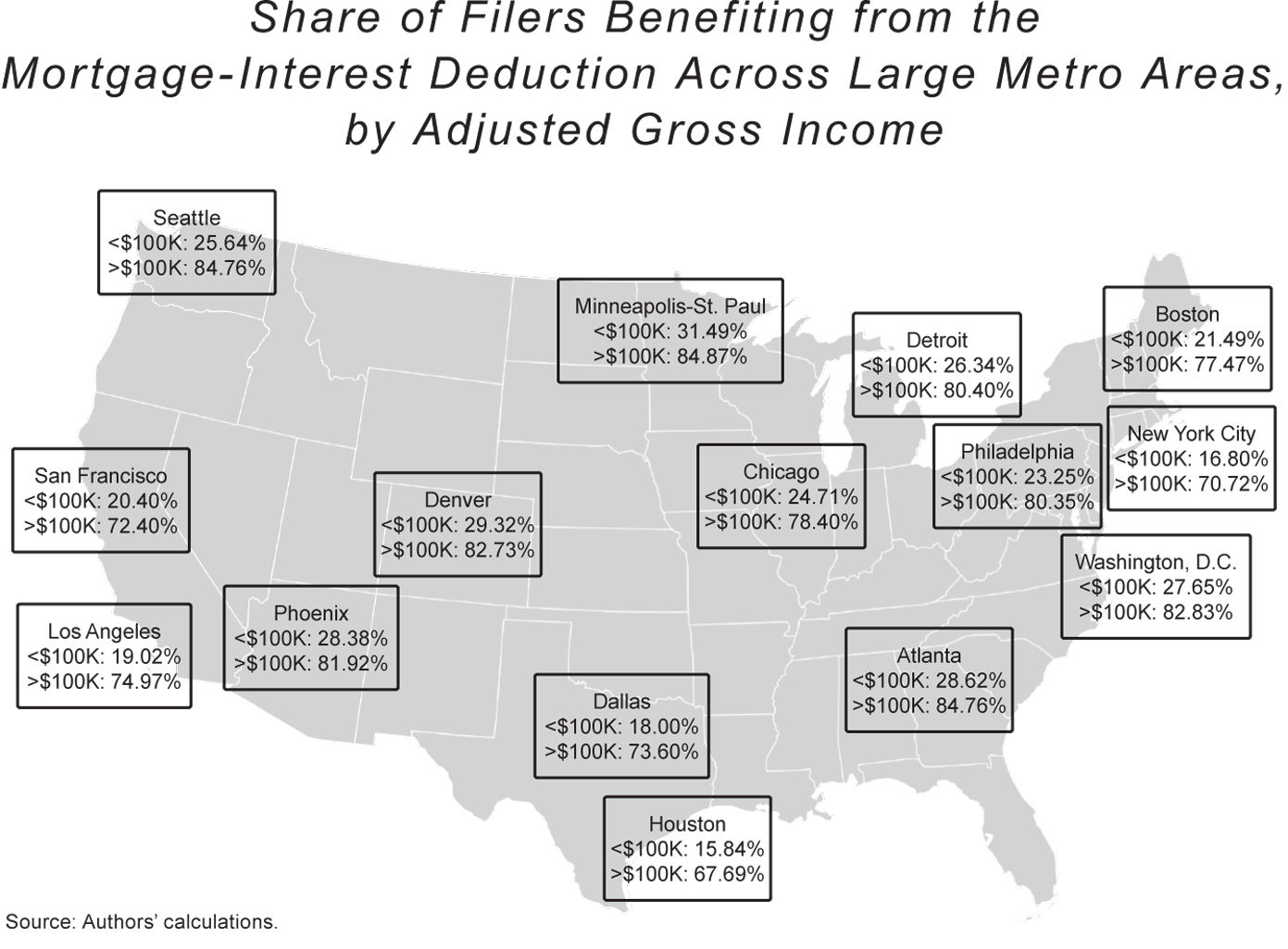

Find A Lender That Offers Great Service. Yes you can include the mortgage interest and property taxes from both of your homes. Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more.

Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. However higher limitations 1 million 500000 if married. However the deduction for mortgage interest.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Susan Wilson Local Direct Private Money Lender Alamo Direct Lending Linkedin

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Vystar Credit Union Review High Interest Rates On Cds

Calculating The Home Mortgage Interest Deduction Hmid

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Rethinking Tax Benefits For Home Owners National Affairs

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Tax Deduction What You Need To Know

Truth Exposed The Dirty Cpf Hdb Scheme To Trick Singaporeans The Heart Truths

Maximum Mortgage Tax Deduction Benefit Depends On Income

What Expenses Can Be Deducted From Capital Gains Tax

Tax Benefits Of Owning A Home

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Nowly Insurance Review Loans Canada